HMRC Integration¶

You can include HMRC Integration as part of your referencing checks for your applicants. Background checks often require confirmation of previous employment and income history. HMRC holds official records that help verify these details, but only for individuals with UK employment history.

Note

- The applicant will still be asked to fill in a full 5 year career history, as the HMRC doesnt cover education gaps or gaps where the applicant may have been volunteering.

Adding a HMRC credit¶

In order to conduct this check, you must first purchase a HMRC Credit from our Market Place. Once purchased, you can add this check to any Custom Bundle that you have created.

To add this check to a bundle, you will need to navigate to Admin > Bundles > Create New Bundle.

Configuring your HMRC Integration Check ¶

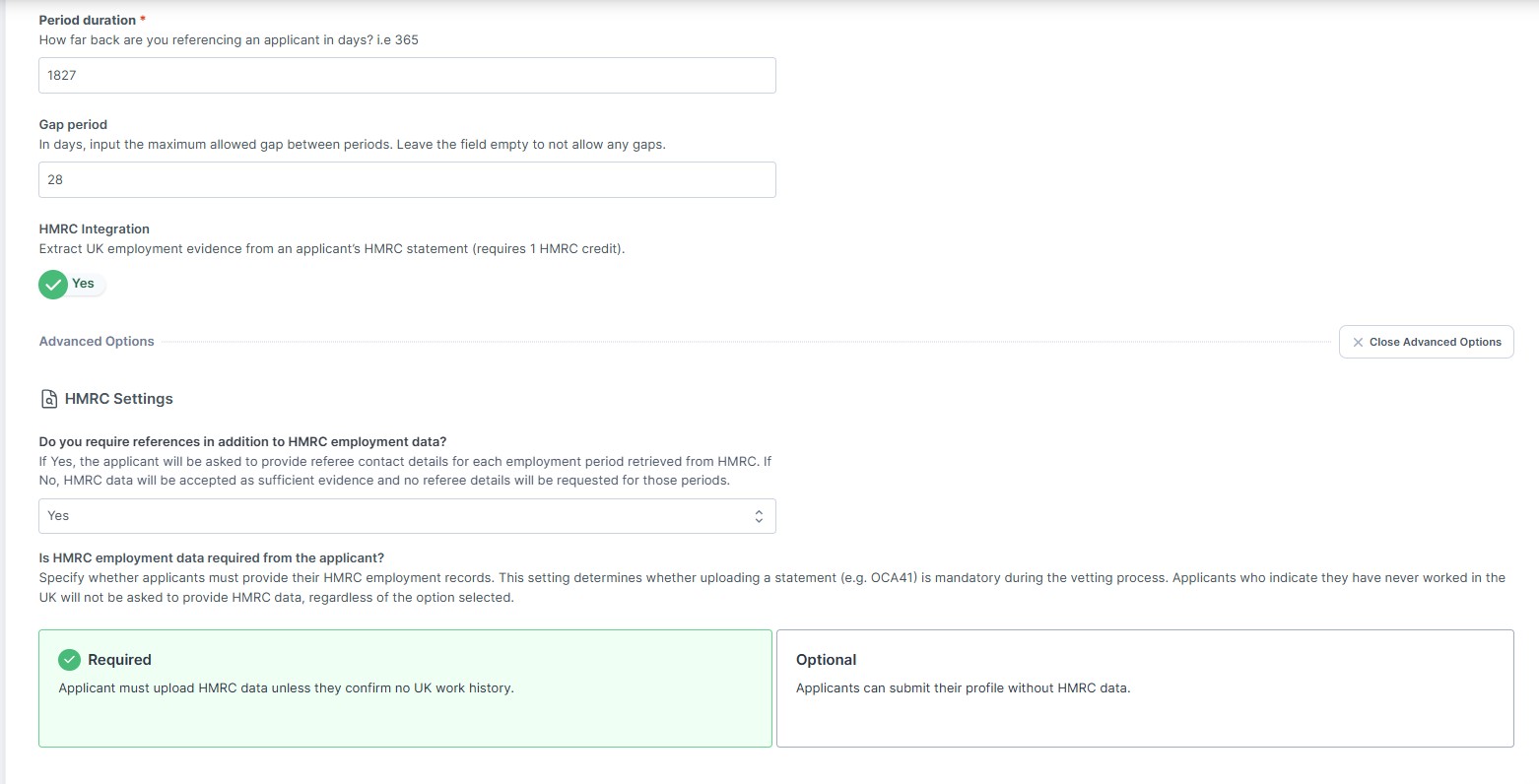

Once you have named this new bundle and selected which category and workflow you would like to use, you will need to click on 'Referencing Checks'. From here you wil be able to toggle on 'HMRC Integration', and you can configure this via the 'Advanced Options'.

-

Do you require references in addition to HMRC employment data? - If you select 'Yes', the applicant will be asked to provide referee contact details for each employment period retrieved from HMRC. If you select 'No', HMRC data will be accepted as sufficient evidence and no referee details will be requested for those periods

-

Is HMRC employment data required from the applicant? - Specify whether applicants must provide their HMRC employment records. This setting determines whether uploading a statement (e.g. OCA41) is mandatory during the vetting process. Applicants who indicate they have never worked in the UK will not be asked to provide HMRC data, regardless of the option selected.

Once you have selected your desired options for this section of the bundle, you may configure the rest of the bundle to your requirements.

Obtaining HMRC information as an applicant¶

The applicant will need to complete their profile (as per the bundle configuration you have created). For the HMRC integration, they will need to obtain proof of income from the HMRC portal, and then upload the document to their profile.

For detailed instructions on how an applicant can obtain their Income Tax and employment history, please click here.

Completing the submitted profile¶

Once the applicant has submitted their profile, you will be able to review the HMRC Tax Statements that the applicant has provided. Please see below for a step-by-step guide:

Once the profile has been marked as 'Completed', the HMRC Tax Statement will be included in the Vetting Report PDF.